Trend Finder

500,00 د.إ

The Trend Finder is a tool or a set of methodologies used in technical analysis to identify and confirm trends in financial markets. This tool helps traders and investors gauge the overall direction of the market or a specific asset’s price movements, providing insights that are critical for making informed trading decisions.

Description

The Trend Finder is a tool or a set of methodologies used in technical analysis to identify and confirm trends in financial markets. This tool helps traders and investors gauge the overall direction of the market or a specific asset’s price movements, providing insights that are critical for making informed trading decisions.

How Trend Finder Works:

- Technical Indicators: Trend Finder tools often utilize various technical indicators to detect trends. Commonly used indicators include:

- Moving Averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA) are used to smooth out price data over a specific period and indicate the direction of the trend.

- MACD (Moving Average Convergence Divergence): This tool uses two moving averages (typically the 12-period and 26-period EMAs) to determine the momentum and direction of a trend.

- ADX (Average Directional Index): Specifically designed to quantify the strength of a trend, a higher ADX value (typically above 25) indicates a strong trend.

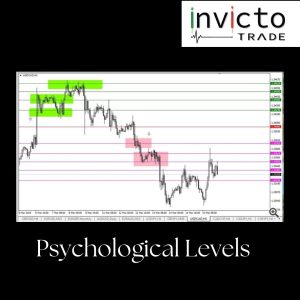

- Chart Patterns: Trend Finder may also incorporate the analysis of chart patterns such as triangles, flags, and pennants, which can indicate the continuation or reversal of trends.

- Trend Lines: Drawing trend lines connecting successive highs or lows on a price chart to visually identify trend direction and strength.

Uses:

- Directional Trading: Helps traders decide whether to take a long or short position based on the identified trend.

- Risk Management: By identifying the prevailing trend, traders can set more effective stop-loss orders and protect against trading against the market.

- Strategy Development: Traders use trend information to develop and refine trading strategies that align with long-term market movements.

Considerations:

- Lagging Nature: Many trend-finding tools, especially those based on moving averages or MACD, are lagging. This means they may not capture the very start or end of a trend.

- Market Noise: In highly volatile markets, trend indicators can be prone to producing false signals, suggesting trends where none exist.

- Complementary Tools: To mitigate risks and enhance accuracy, Trend Finder tools are often used in conjunction with other indicators and analysis techniques.

Strategies:

- Multi-Timeframe Analysis: Using Trend Finder tools across different timeframes (e.g., daily, weekly, monthly) to confirm trends and filter out market noise.

- Combination with Volume: Integrating volume analysis can confirm the strength of a trend. For example, an uptrend with increasing volume is generally more reliable.

- Divergence Analysis: Looking for divergences between price trends and momentum indicators (like RSI or MACD) to spot potential trend reversals.

Trend Finder tools are fundamental in technical analysis, helping traders and investors identify market trends to make more strategic trading decisions and better manage their portfolios.

Reviews

There are no reviews yet.