Description

A Price Level Alerter is a tool or feature commonly used in trading and investment platforms to notify traders and investors when the price of a security, commodity, currency, or any other tradeable asset reaches a predefined level. This tool is crucial for those who aim to maximize their trading efficiency, manage risks, and capitalize on market opportunities without the need to constantly monitor price movements manually. Here’s a breakdown of what a Price Level Alerter offers and how it can be utilized effectively in trading strategies:

### Key Features of a Price Level Alerter

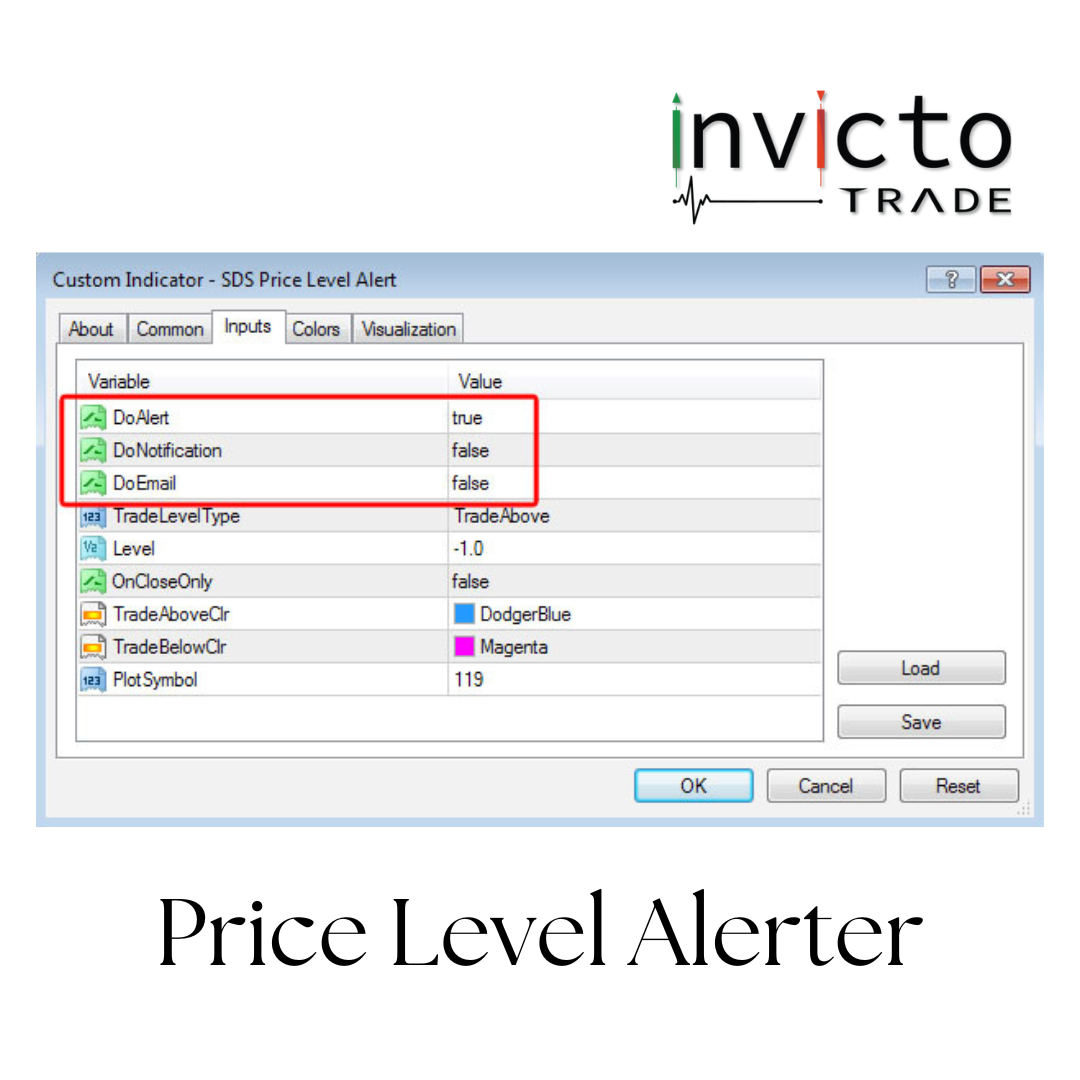

– **Customizable Alerts:** Users can set alerts for specific price points, ensuring that they are notified immediately when these levels are reached. This feature allows for precise market entry and exit strategies.

– **Multi-Asset Support:** Most alerters are designed to monitor a wide range of assets, including stocks, forex, commodities, and cryptocurrencies, making them versatile tools for diversified portfolios.

– **Real-Time Notifications:** Alerts are typically delivered in real-time, through SMS, email, or push notifications on mobile and desktop trading platforms, allowing traders to act swiftly on market movements.

– **Risk Management:** By setting alerts at key support and resistance levels, traders can manage their risk more effectively, placing stop-loss orders or taking profits at predetermined levels.

– **Technical Analysis Integration:** Advanced alerters can be integrated with technical analysis tools, triggering alerts based on technical indicators or patterns, not just price levels.

### Utilizing a Price Level Alerter in Trading

**1. Setting Target Entry and Exit Points:** Traders can set alerts for potential entry and exit points based on their analysis, ensuring they don’t miss optimal trading opportunities.

**2. Monitoring for Breakouts or Reversals:** Setting alerts around key resistance or support levels can help traders identify potential breakouts or reversals as they happen.

**3. Implementing Stop-Loss Strategies:** Alerts can be used to monitor prices nearing stop-loss levels, giving traders a chance to reassess their positions and strategies.

**4. Capitalizing on Market News:** In response to anticipated market-moving news, traders can set alerts to monitor volatility and price movements closely, enabling quick decision-making.

**5. Diversification and Portfolio Management:** For those managing diversified portfolios, alerts provide a way to keep tabs on multiple assets across different markets, ensuring no critical movements are missed.

### Conclusion

A Price Level Alerter is an essential tool for modern traders and investors, offering the ability to stay informed of market movements without constant manual oversight. Whether for day trading, swing trading, or long-term investing, leveraging such alerts can enhance strategy effectiveness, improve decision-making, and help achieve better overall trading outcomes. With the increasing sophistication of trading platforms, these alerters are becoming more advanced, providing a broader range of customizable options to fit the specific needs and strategies of individual traders.

Reviews

There are no reviews yet.