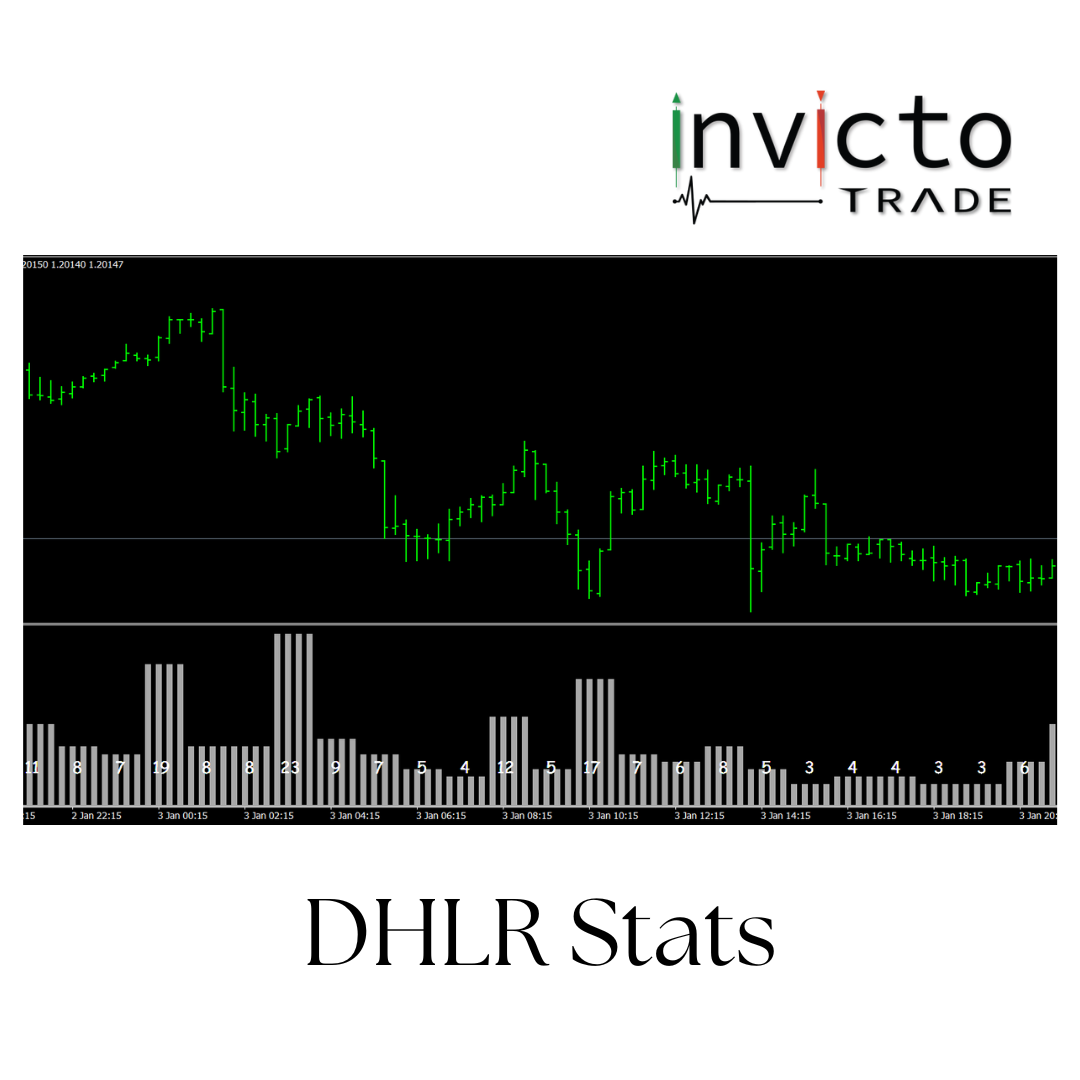

Description

The term “DHLR Stats” isn’t immediately recognizable as a standard term within financial markets, trading, or statistical analysis, as of my last update. It’s possible that “DHLR” could refer to a specific indicator, tool, acronym for a statistical method, or even a company or software name that’s relevant in a particular context or industry. Without more context, it’s challenging to provide a precise answer.

In trading and financial analysis, acronyms and abbreviations are common, but they can vary widely in their application and meaning. For example, terms like MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and EMA (Exponential Moving Average) are well-known and widely used. If “DHLR” refers to a niche or newly developed tool, strategy, or concept, it might not be widely recognized outside of specific circles or might have emerged after my last training data in April 2023.

If you’re referring to a specific trading indicator, statistical method, or any other concept with the acronym “DHLR,” could you provide more details or clarify the context? This would greatly help in giving you a more accurate and helpful explanation or description.

Reviews

There are no reviews yet.